The Effects of Trump’s Tax Cuts

October 25, 2017

If you’ve been watching the news lately, you have probably heard about tax cuts. Fact: no one wants to pay taxes, but it’s something we have to live with as United States residents. Currently, the majority of our taxes are regressive, which means that no matter how much money you make, you pay the same percent as anyone else. The real problem lies in the second type of tax, progressive tax. Progressive tax is based off of the income percentile in which you live. Progressive tax includes our property tax, as well as our income tax. If you are in the 97th percentile of income, then you pay the same as others in the 97th percentile, and so on. Even then, you can get deduction based on mortgages, as well as giving to charity, which benefits the higher class.

Now the question is, how does this effect to us?

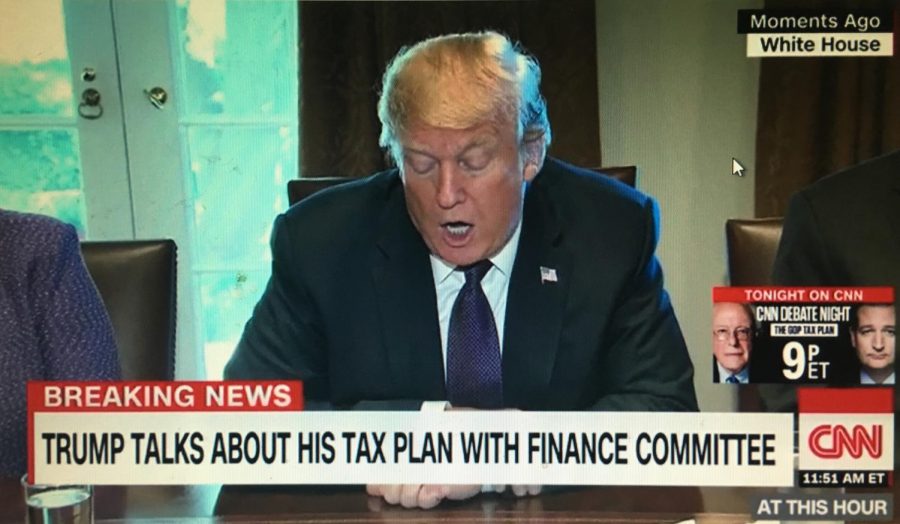

President Trump is planning to reduce taxes. Yay! Too bad it’s not as good as it seems. Under new regulation taxes decrease for the higher class, and only the high class, while the amount of money that the middle and poor classes have to pay increases. According to Dean Obeidallah in the article, “Guess who loses with Trump’s tax plan?” (published by CNN), other than a 1% tax break in 2018, “By 2027, more than one of every four middle-income families would pay more in taxes”. Another Regulation is increasing the mortgage, and charitable deductions. This is a progressive deduction, meaning that the more property you own, the more money you give, and the more money you make, the more money you will save.

There is no guarantee with the tax deductions that federal spending will decrease, which could increase the federal debt. The United States is already in a load of debt, and as that debt increases, our generation will have to face the aftermath. The Annenberg Public Policy Center of the University of Pennsylvania predicts that with the increase in federal debt, taxes will have to increase in the future, and by then we will be the tax payers trying to pay off a debt that just keeps getting bigger.

We need to raise awareness to the people around us who can vote, to make sure that our future is not set in stone. As a community, we can speak to our parents, our neighbors, or family friends about the situation, and hope to get our message across.